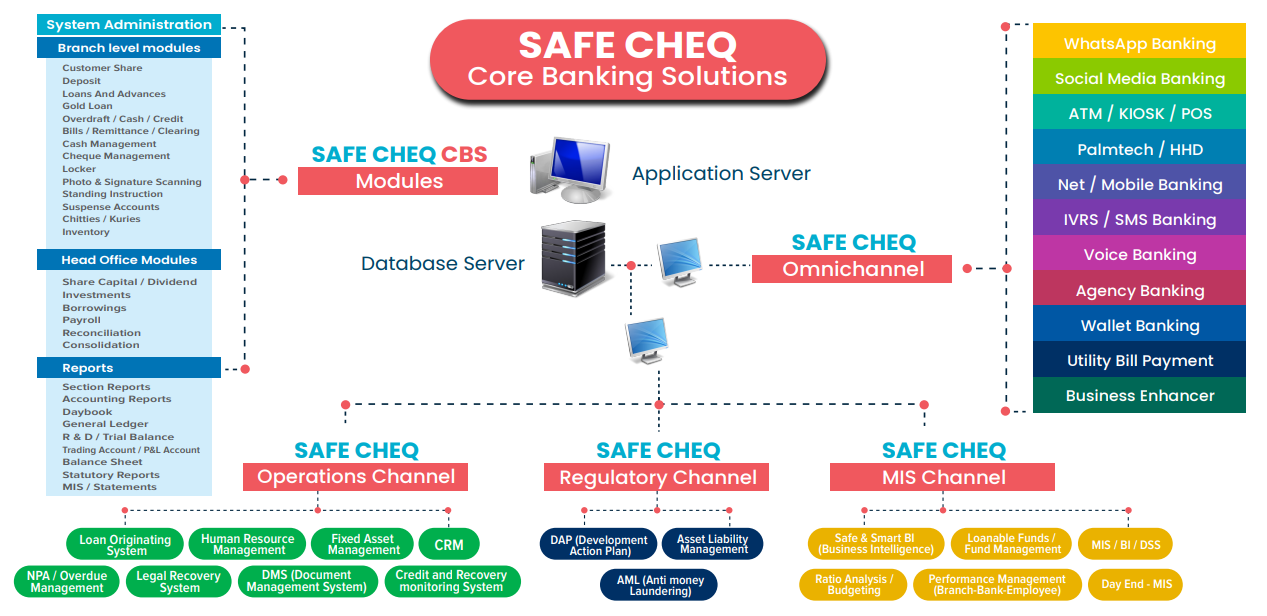

Introduction

A complete web-based solution with the opportunity to meet present challenges with reduced cost and enhanced customer management measures.

The solution helps to streamline the current business processes with a supporting technology while Information Management and Risk Management is the key.

An ideal Core banking scenario where products, processes, channels, customer information and management tools are integrated and administered through a central database of the bank with branches and channels as delivery points. This helps in achieving economies of scale by data integration for various purposes such as cross selling, CRM, Regulatory R porting and internal MIS